Since March last year, we have seen banks triple their revenue through online channels. That’s great, but what we aren’t seeing with these stats is the other side. The short-term impact on direct personal channel revenue streams and the long-term impact on the client relationship.

Digital needs in the Middle East vs. personal relationships

The main need to offer digital functionality comes as a result of many different elements including demographic changes.

The primary significant factor is increased growth in its younger population than other regions. This growth is set to continue and, as a result, the region has an unusually high penetration of smartphone users. According to Deloitte, mobile phone penetration is already at 97%, and thus there is a strong requirement for mobile first banking services. These user expectations extend to well established wealth advisory services that are available within an online, end-to-end system.

In addition, we are seeing the demand for wealth advisory services expand beyond high-net-worth individuals (HNWIs) to the mass affluent. A new ‘middle class’ is being created by increasing education levels within the region, along with a greater number of women entering the workforce, and a growing expatriate community. These audiences are looking for extended wealth management services for accumulation, and digital enables banks to service them efficiently like never before.

To service these groups a robo advisory wealth service may be considered sufficient. These enable clients to have instant, self-service access, automatic support and tools to allow them to invest without the need to converse with a personal relationship manager. It can enable those that are not used to investing to now be guided through intuitive, simple interfaces and model scenarios.

These services are ideal for those that have less than US$ 100k to invest or are financially savvy, but what happens if you expect this demographic to develop from a mass affluent to a HNWI and the investment requirements are getting highly sophisticated? And on the other side, what if you have a HNWI individual that is digitally savvy and expects to be supported 24/7 instant access to automated tools and functions? These questions are important to consider, particularly as, in a recent survey[1] with Hubbis to wealth managers in the Middle East, most (88%) of respondent’s clients are expected to seek advice or delegate investment decisions to a bank/asset manager. This doesn’t of course undermine the benefit of offering just robo solutions when targeting the mass affluent segment, but it does highlight a need to consider an alternative digital product that supports digital HNWI’s alongside more complex financial investment solutions.

The changing expectations of the customer

Servicing HNWI’s to maintain the close relationships needed for optimum profitability and client retention, all while offering the benefits of robo, could be considered an impossible aim. But at additiv, our clients realize that that this fantasy can become a reality through a hybrid model, and this expectation isn’t limited to our clients.

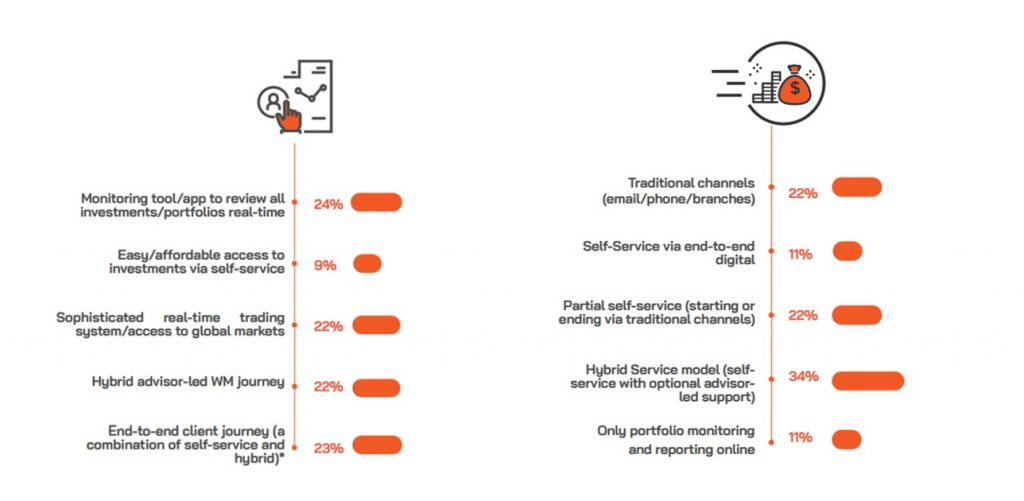

As part of the survey, we conducted with Hubbis, this need was further highlighted:

| What do you consider to be the most important digital investment and wealth management offering for your clients? | What are your investment and wealth management channel preferences in 2021? |

Source: additiv & Hubbis 2021 Survey – Wealth Management in the Middle East: An Insight into the Current and Future Needs of Investment Clients

What’s clear from our survey to wealth managers in the region is that optionality is important. There was an equal balance between four key focuses; two of which focus on a purely hybrid model (55%), however, sophisticated real-time trading system/access to global markets (22%) and monitoring tool/app to review all investments/portfolios real-time can also be offered through a hybrid approach.

What hybrid wealth really means

A hybrid model allows clients to be offered the service that best suits their individual needs and chose how they want to be serviced. Depending on these needs, the advice or support available is human or self-service, supported by intelligent analytics and offers real value:

- It enables clients to be serviced more efficiently (only support when there is a real need).

- It allows advisors to walk through proposals, optimizations and simulations in real-time; and

- It ensures relationship managers remain productive and focused on clients when it matters most, which in turn improves scalability for banks.

Rather than impeding the client relationship, it actually encourages collaboration, supporting in-person and remote advisor and client conversations through a multitude of channels, going way beyond the “next best trade concept”.

However, there is a common misconception about one aspect of a hybrid service: the self-service approach. In contrast to robo-advisor online wealth management platforms, which only offer automated portfolio management, the self-service model is complimentary to the personal direct access to the relationship manager. It allows clients to gain insights and complete actions that historically would have been undertaken by an advisor as an administrative function. These self-service functions are designed with HNWIs in mind, intuitively offering them support based on their profile, as opposed to mass affluent functionality that is designed for a different demographic.

Supporting HNWI’s through WealthTech

To capture these new markets and maintain competitive with existing customer bases, the right IT infrastructure is imperative. Presenting customers with better user interfaces isn’t sufficient. HNWI’s are looking for better experiences and access to bespoke investment solutions according to their individual needs, at a reasonable price.

During the COVID confinement period, one of the largest retail banks in Switzerland, PostFinance, launched an end-to-end digital platform that does just this. It caters to the needs of customers wishing to diversify away from low-yielding savings products. The platform offers a seamless and engaging end-to-end customer journey to both advisory and discretionary customers and, unsurprisingly it is seeing massive take-up adding around 6000 customers and CHF 300m in assets under management within the first nine months alone.

PostFinance’s success in part can be attributed to them recognizing the importance of how clients wish to interact with their bank varies and evolves throughout their relationship along with the market environment. There will be periods when bank clients wish for independence, and at other times they’ll seek guidance on the risks involved. They might even want the bank to handle everything. A hybrid approach enables this – so now HNWI’s really can have the best of both worlds (and so can wealth managers).

[1] Wealth Management in the Middle East: An Insight into the Current and Future Needs of Investment Clients, additiv survey with Hubbis, March 2021