Egypt is now backing a more flexible currency to support its economy, a top-level government official said Tuesday, as the Arab world’s most populous country has suffered successive economic shocks from the COVID-19 pandemic and the war in Ukraine.

“We as a government do agree that a flexible exchange rate is definitely good for the economy,” Hala Elsaid, Egypt’s Minister of Planning and Economic Development said in an interview with Bloomberg TV.

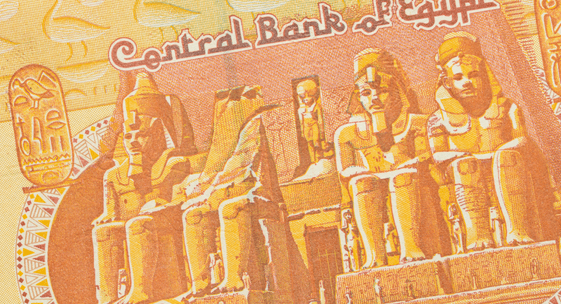

Egyptian authorities have been ramping up efforts to fight inflation, including the central bank’s decision to devalue the local currency in March. However, investors and economists believe the Egyptian pound has much further to go to reflect its true value.

The currency is down more than 18% so far this year, according to Bloomberg. Investors are expecting a second wave of depreciation while Egypt is in talks with the International Monetary Fund, which favours a more flexible exchange rate, for a new loan.

The resignation of Central Bank of Egypt (CBE) Governor Tarek Amer last month has raised concerns about the currency outlook. CBE’s Monetary Policy Committee (MPC) also kept the overnight deposit rate, overnight lending rate and the rate of the main operation unchanged at 11.25%, 12.25% and 11.75%, respectively for a second consecutive meeting.

Bank of America (BofA) economists projected Egypt’s gross external funding needs for the full year of 2023 at $58 billion or about 14% of GDP. BofA said the government was likely to secure a $15 billion extended fund facility program from the IMF for three years.

The country’s non-oil economy showed a softer decline in operating conditions in August. Egypt Purchasing Managers’ Index rose to 47.6 from July’s 46.4, but it remained below 50.0, the contractionary territory.